In spread betting, you stake an amount of money per point for every price movement in an asset. For example, if you think the X share price will rise, you could place $50 per point of movement. If the price rises by 10 points (10 P) you can have $500 minus any additional cost, but if the share price drops 10 P you could lose $500

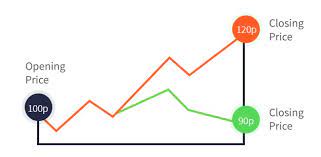

In trading CFDs, you exchange the difference in price from when a contract is open until it closes. For example, if you think that the X share price is going to rise, you can buy $50 share CFDs of X, which is like buying the equivalent of 50 X shares. If the price rises by 10 P you profit $500 minus the commission fees. However, if the price falls by 10 P, you will lose $500.

According to Capital.com, CFDs allow you to predict various financial markets like indices, stocks, forex pairs, commodities, and cryptocurrencies. You cannot buy the assets but you can trade on their fall or rise in price over a short time.

Also Read: 5 Tips Every Trader Must Know Before Forex Trading

Spread betting vs. CFDs

The primary difference between CFD trading and spread dating is how differently they are treated for taxation. For spread betting, you are exempted from capital gains tax and stamp taxes while in CFD trading you are taxed the capital gains tax. Spread betting is available in Ireland and the UK only while CFD trading is available worldwide.

Spread betting has expiry dates after placing the bet while in CFD contracts there is no expiry. Spread betting is done by a broker over the counter while there are platforms used for CFD trades online. You can do CFD trading by yourself online without a broker. Because you have direct market access in CFD trades, you can avoid market pitfalls because the electronic platforms are simple and transparent.

Aside from splitting margins, CFD trades require the user to pay a commission and transaction fees to the provider. However, in spread betting, users are not charged commissions or transaction fees. After the contract is closed in CFD trading, the investor either owes the trading company money or is owed money by the trading company.

If the trade was successful, the CFD trader calculates the net profit at the closing position minus the fees charged and the opening position. To calculate the profit in spread betting, you find the change in the basis point and multiply them by the dollar amount you negotiated while placing the first bet. If you enter a long position payout, you are subjected to paying dividends in both the CFD trading and spread betting.

Although the companies do not own the asset in question directly, the spread betting and providing company in CFD trading will pay dividends if the underlying asset is paying as well.

Trading in CFDs is a little easier than trading in spread betting because of the accessibility and the fact that it is available worldwide. While choosing a platform for CFD trading, consider the fees and commission charged by the providers.

Also Read: A Complete Overview of Implied Volatility